As we enjoy the early fall weather – especially for those in the north – do you ever wish you could ‘bottle up’ a few warm sunny days and save them for the colder winter months? Throughout history, people have stored resources during plentiful times to use during times of scarcity. Electricity is a valuable resource that has historically been difficult to economically store at scale. In this month’s article, we’ll reflect on a series of questions regarding electric energy storage technologies, economic and political challenges, and potential opportunities.

What are the benefits of battery energy storage systems (BESS)?

According to the U.S. Department of Energy, enhanced energy storage can provide multiple benefits to electric consumers and utilities. Among these benefits are:

- Improved power quality and the reliable delivery of electricity to customers

- Improved stability and reliability of transmission and distribution systems

- Increased use of existing equipment, thereby deferring or eliminating costly upgrades

- Improved availability and increased market value of distributed generation sources

- Improved value of renewable energy generation

- Cost reductions through capacity and transmission payment deferral

As an electric consumer, why would I want to consider electric energy storage?

Battery systems create operational and economic value using a combination of financially optimized hourly usage, limited costly power disruptions, help for the regional grid in responding to changing conditions, and expanded reliability of operation and penetration of renewable resources to help meet decarbonization objectives.

Financial Returns – Energy storage creates economic value when electric use is shifted to lower-cost hours and is reduced during costly grid peak hours. In many electric markets, up to 40% of annual electric costs are determined by your usage during the 5-12 hours of grid peak load. A properly dispatched BESS reduces your usage during these costly hours and significantly reduces electric costs. Regional grid operators often compensate users that reduce usage during grid emergencies and/or quickly adjust usage to help balance the grid. BESS enable retail electric customers to participate in these utility programs without disrupting operations.

Resiliency – What is the cost of a short-term power outage to your organization? BESS quickly responds to power outages, avoiding costly short-term disruptions and providing temporary power for critical resources. Most facilities have small uninterruptible power supply (UPS) systems to provide transitory power during brief power outages or to power emergency electric circuits in commercial buildings. BESS offers similar benefits on a larger scale. Large-scale batteries can provide temporary power to avoid disruption to your operations and, when additional equipment is installed, aid the transition to emergency generators powering critical facilities during longer term outages.

Decarbonization objectives – Intermittent renewable generation resources such as wind and solar are becoming more prevalent as organizations commit to renewable energy and strive to meet decarbonization objectives. These intermittent resources generate carbon-free electricity, but that generation varies each day and throughout the seasons of the year. As leading organizations strive to match a high percentage of their hourly energy consumption to renewable energy generation, energy storage becomes a valuable tool to balance renewable generation and electricity consumption. Federal investment tax credits are available to systems specifically charged by renewable resources.

Qualified and experienced partners are required to determine the best economic strategy to balance your organizational and economic priorities and reliably optimize the operational dispatch of battery systems.

What are typical economic revenue streams available to fund energy storage applications?

Demand Mitigation – In many areas, customer-specific usage during regional grid peak hours (often known as Peak Load Contribution, or PLC) can account for 20-40% of annual electric expenses. In other areas of the country, these charges are based on your highest peaks for the month. Strategically deployed batteries help limit or avoid energy consumption during these peak hours. This reduces the generation capacity and transmission resources required in the region and captures significant savings while contributing to a more efficient grid.

Economic Load Response – The economic value of energy varies from hour to hour. Energy storage enables facility operators to store electricity (charge the storage) during lower cost periods and deploy the generation (discharge the storage) during higher cost periods.

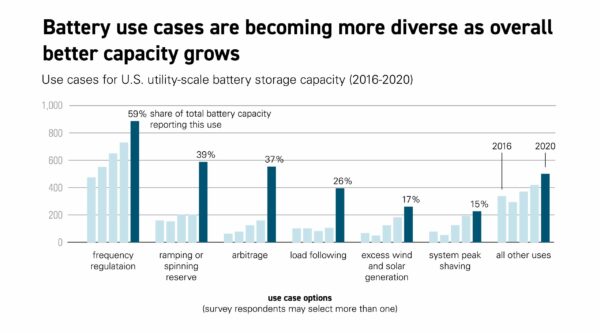

Ancillary Services – Regional grid operators use ancillary services to help balance the transmission system to ensure grid reliability for consumers. The operators compensate resources, such as energy storage systems, that perform these balancing and frequency regulation services. According to the Energy Information Association (EIA), frequency regulation and reserve services account for the majority of existing battery storage applications.

Source: EIA-860 Annual Electric Generator Report, 2021 EIA Energy Storage Workshop (Nov. 18, 2021)

Are facility BESS the same batteries used in Electric Vehicles (EVs)?

Facility batteries come in a variety of technologies that often overlap with EVs. The most common technology used today in BESS and EV applications is Lithium ion (Li-ion). Within this Li-ion family, the two most commonly used chemistries are Lithium Iron Phosphate (LFP) and Nickel Manganese Cobalt (NMC), with each chemistry offering advantages depending on the application of the battery. According to recent articles in the Wall Street Journal, both Li-ion chemistries are being used in various EVs, with Ford, Tesla and Chinese manufacturers primarily turning to LFP and General Motors committed to NMC.

How is the growth of EVs impacting stationary energy storage pricing and deployment?

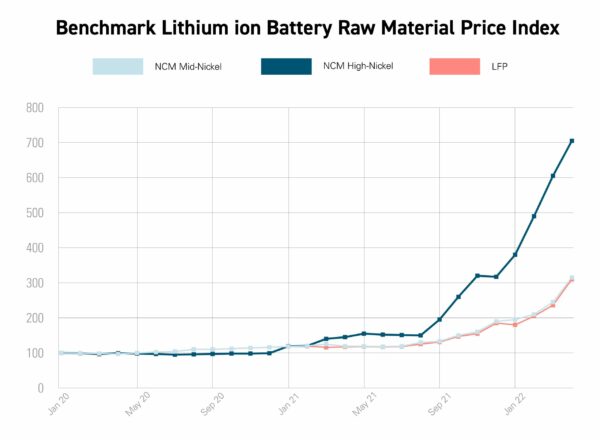

To meet aggressive EV production schedules, manufacturers are competing to contract with battery manufacturers and reserve critical minerals used in the production of Li-ion batteries. Stationary BESS uses the same supply chain materials and pricing has significantly risen over the past year, as shown in the chart below.

Source: Batteriesnews.com (Apr. 18, 2022)

Compared to stationary BESS, EVs are better positioned to absorb the higher prices, as the battery cost is a smaller percentage of an EV. As of August 2021, the EIA reported roughly 3 gigawatts (GW) of battery storage installed in the US and expected 8.9GW of additional energy storage to be deployed by 2024, including approximately 380 megawatts of behind-the-meter commercial and industrial installations. With rising initial capital costs, effective BESS dispatch strategy and deployment will be required to maximize project investment returns.

Are there government incentives to help offset the increasing cost of BESS?

The recently passed Inflation Reduction Act of 2022 Includes several key incentives to promote the economical implementation of BESS. Previously, BESS tax credits required that storage be charged with renewable energy facilities. The new legislation now enables standalone storage projects to receive tax incentives. The following is an overview summary of available incentives, subject to meeting a series of defined requirements.

30% Project Investment Tax Credit (ITC)

- BESS Base ITC Credit: 6% ITC

- Prevailing wage and apprenticeship requirements: Additional 24% ITC, if labor requirements are met including local prevailing wage rates for the duration of the project construction and 5 years after for repairs/alteration, plus apprenticeship requirements during construction.

- The prevailing wage and apprenticeship requirements apply to projects that start construction 60 days or later following the date the guidance is provided by the Secretary of the Treasury. Projects that begin construction prior to this date qualify for the full 30% ITC and are not subject to the prevailing wage and apprenticeship requirements.

- Be aware of taxpayer penalties for failure to satisfy the requirements.

Bonus ITC opportunities:

On top of the combined initial tax credits, projects can earn up to 20% additional credits by meeting additional requirements:

- Domestic content requirements: Additional 10% ITC

- For manufactured products such as BESS, a minimum of 40% domestic content is required for projects starting construction before 2025 and escalating domestic content requirements thereafter.

- Located in energy communities: Additional 10% ITC

- Energy communities include brownfield sites, or statistical areas with a combination of fossil fuel employment or industry revenue and unemployment above the national rate, or an adjoining census tract to a closed coal mine or coal-fired electric generating unit.

Again, this is a high-level overview of available incentives. Each incentive opportunity must meet extensive requirements, and some guidance has not been published yet. Ensure your project team includes professional tax guidance and diligent review.

When it comes to state and regional utility incentives, the North Carolina Clean Energy Technology Center, which operates the dsireusa.org website, shows 33 additional incentive programs for commercial and residential BESS.

An effective energy storage partner will help uncover all available incentives for your specific project.

Interested in learning more?

Battery energy storage systems are a tool in the effort to economically achieve grid optimization and stability in the transition to a carbon-free electric grid in the coming decades. These are significant investments with technology considerations and economic tradeoffs to consider. Wherever you are in your energy transition journey, the OnSite Partners Advisory team is available to help develop a holistic and end-to-end view of these investment considerations, partner to invest, own, operate and maintain these assets, or economically dispatch your generation assets. In the meanwhile, we sincerely hope you can escape to enjoy these beautiful fall days, as they can’t be stored!

If you’ve found this blog informative and would like to learn more, please contact us online.

Sources:

- The Wall Street Journal: GM Slows Down, Needs More Batteries (July 26, 2022)

- The Wall Street Journal: Redwood Materials Plans $3.5 Billion Battery-Materials Plant in Nevada (July 25, 2022)

- DSIRE: NC Clean Energy Technology Center

- Energy Storage Association: U.S. Energy Storage Market & Drivers, EIA Energy Storage Workshop (November 18, 2021)

- U.S. Energy Information Administration: U.S. Battery Storage Market Trends, 2021 EIA Energy Storage Workshop (November 18, 2021)

- BatteriesNews.com: Benchmark Launches Lithium Ion Battery Raw Material Price Index (April 18, 2022)