In the alphabet soup of common business parlance, the letters ESG – standing for environmental, social and governance – are certainly not new, but they increasingly get to rub elbows with the likes of EBIT and ROI. Aimed at providing a measure of a company’s long-term sustainability, an ESG score is compiled from metrics relating to the type of assets not ordinarily found on a balance sheet. In this article, we’ll take a look at the history of ESG and its trends and discuss the importance of factoring ESG into your business decisions.

After decades of disagreement among economists over whether companies’ societal impact has any bearing on financial performance, it is now understood that the effect on value is very real. Today’s consumers look beyond the cost/value trade of the product being considered; they want to place their spending power with companies that treat their workers well and conserve resources for future generations. With that evolution of relevance and reach, what sets ESG issues apart from more traditional financial metrics is that they apply to a far wider field of potential audiences. ESG-related goals are increasingly becoming part of companies’ identities and drive not only investor choice but also consumer choice. As a result, organizations are challenged to choose strategies and ultimately communicate and report on steps taken and milestones achieved along their respective sustainability roadmaps in a way that strikes the appropriate balance of information at the intersection of investor confidence and consumer protection. One thing is certain, as varied as the audiences of ESG reporting may be, they all agree that the principle of “buyer beware” is no longer good enough.

The net cast by environmental, social and governance issues is a wide one ranging from greenhouse gas emissions, waste and water management, human and animal rights and consumer protection to management structure and compensation, to name just a few.

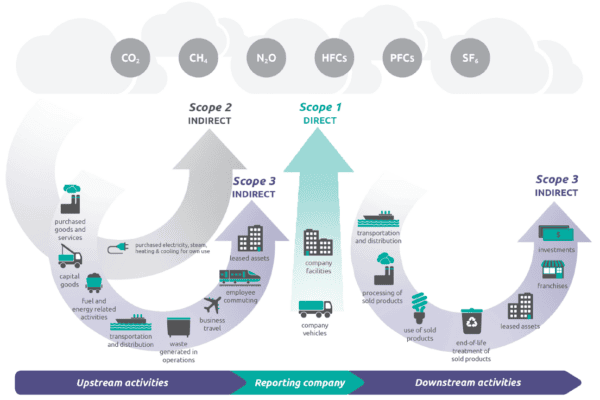

In the context of environmental sustainability efforts, companies often focus on the reduction of their Scope 1 and 2 emissions (as defined by the Environmental Protection Agency (EPA)) given that these are easiest for the organization to access directly and reduce through organizational commitment and choices. Traditionally, the business decision to replace equipment, for example, to a less energy-intensive technology would have been exclusively financial. While corporate financial stewardship undoubtedly continues to be a key determinant of long-term viability, ESG reporting tools today would capture the more intangible aspects of corporate strategies and make them available to the investment community and consumers alike. The added bonus of potential ESG-related accolades does not mean that choosing appropriate business projects has suddenly become easier but rather introduces more variables and complexities to consider. Corporate sustainability professionals generally face the challenge to champion projects that check all of the boxes: they must demonstrate measurable impacts towards the company’s sustainability goals while not introducing new, unintended consequences of potential reputational harm, as well as operate within budgetary constraints. Finally, when it comes to the measurement and reporting of such metrics supporting the sustainability goals, companies must be able to communicate them in an effective way to the various relevant audiences which can be organizationally taxing, as well as introduce potential liability issues.

EPA defines Scope 1, 2 and 3 emissions across the corporate procurement chain in the example below.

Source: EPA.gov

The Rise of ESG Goals

Let’s examine in some more detail how the trend of considering ESG issues as part of institutional investment decisions has emerged over time and how it has shaped the current state of demand for insightful ESG information which continues to evolve.

Nearly two decades ago, in 2005, The United Nations set out to cause the development of voluntary and aspirational Principles for Responsible Investment. The collaboration of a multi-national group of institutional investors resulted in the launch of The Principles at the NYSE in 2006 and formalized the stance that ESG issues can affect the performance of investment portfolios. Signatories of The Principles pledged to consider ESG issues in investment analysis, for example, by seeking appropriate ESG disclosures. The emphasis on seeking additional insights on company ESG activities was one of the first dominoes to fall leading to today’s expectation of fully informed investment or contract decision making. Over time, and especially accelerating through and after the 2008/09 financial crisis, more investment companies joined the original signatories passing the milestone of over $100 trillion assets under management being represented in late 2020.

Since the initial publishing of The Principles, there have been many initiatives – some more formal than others – to create a set of standardized and streamlined reporting rules that could be utilized to make public disclosures more comparable such as the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD).

Many are looking to the U.S. Securities and Exchange Commission (SEC) to step in to establish standards in accordance with their mission of protecting investors, maintaining fair and efficient markets and facilitating capital formation. Companies now routinely include their corporate sustainability reports in whole or part with regular SEC filings or directly respond to various requests for additional ESG information. It is widely understood that answering ESG reporting requests is good practice, but the lack of a uniform standard leads to both cumbersome practices on the companies’ sides as well as heavy need for interpretation by potential investors. Earlier this summer, SEC Chairman Gensler announced in a speech that he had asked the SEC staff to “develop a mandatory climate risk disclosure rule proposal for the Commission’s consideration by the end of the year.”

Investor and Consumer Interest in ESG

To rise to this charge, SEC staff will need to consider which ESG-related items would be of material importance to investors, as well as which disclosure requirements are appropriate not only now but would withstand the test of time as the science surrounding climate change continues to evolve. Chairman Gensler’s call to action includes considerations to create truly comparable means of disclosing quantitative information, how Scope 3 emissions should get reported and whether industry specific metrics should be available.

Aside from these pragmatic considerations of the what and the who and how often, the Commission also needs to consider that many U.S. corporations are also players in international markets and follow other legislations’ reporting requirements, which in some cases incentivize practices that are not relevant to the reach of the SEC.

Investor interests, however, are only part of the picture. Modern consumers demand strong ESG accountability from companies and public opinion in the age of social media has the capability to direct significant spending power towards or away from companies that either do or don’t live up to sustainability related expectations. Here companies must strike a good balance between delivering meaningful and specific sustainability claims that meet consumers’ expectations of “moving the needle” while making sure all specific claims can be supported and must never constitute a material misrepresentation influencing a purchasing decision in order to not run afoul with consumer protection laws.

Get Started

Interested in learning more?

In an environment where making the ESG-related claim is a key benefit of the action taken, communication strategies take center-stage to both discussion of value and liability.

As energy professionals, we at OnSite Partners are uniquely qualified to help you discover energy solutions that will advance your progress on your environmental sustainability roadmap, as well as consider their meaningful placement on your ESG reporting and other communication strategies to reach all of your relevant audiences. Our experienced Services professionals can help with establishing a custom Decarbonization Roadmap to meet your ESG goals.

If you’ve found this blog informative and would like to learn more, please contact us online.