There is a significant amount of waste energy from industrial processes that rely heavily on fossil-based generation fuels. Typically, some of the energy used in these processes is not put into practical use and is lost or wasted. Recovering the waste energy can be conducted through several technologies and can provide valuable energy sources that reduce your energy consumption, while also being a part of your sustainability plan. And, with federal tax incentives now in place through the Inflation Reduction Act, businesses can realize up to 50% tax credits for the installation of waste energy to power technology.

In this article, we will explore the various types of waste energy technologies and their benefits.

What is waste energy recovery?

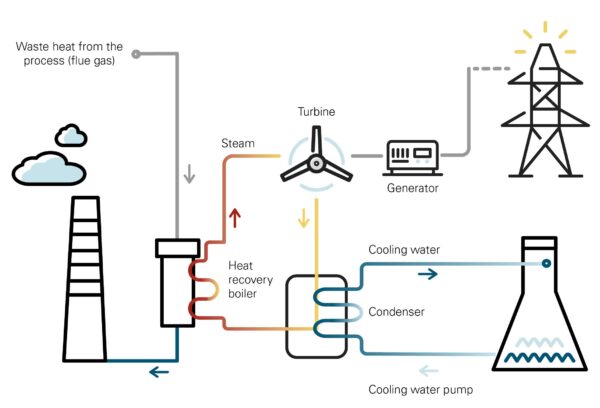

Waste energy recovery is the process of capturing energy discarded by an existing high temperature or high-pressure process and using that heat or pressure letdown to generate power (see Figure 1). Manufacturers with energy-intensive processes can reduce waste and be more energy efficient by harnessing the hot exhaust gases or waste released from these processes and convert it into electricity through the use of a variety of technologies, such as those listed below.

Waste energy recovery technologies

- Organic Rankine Cycle (ORC): An ORC is a type of heat engine that uses an organic fluid as its working fluid. The fluid is vaporized by the waste heat, and then the vapor drives a turbine to generate electricity. ORCs are well-suited for applications with low-grade waste heat (300-1000 degrees Fahrenheit), such as the exhaust gases from industrial processes. Businesses that would benefit from ORCs include pipeline compression stations, industrial facilities, and data centers.

- Turbo Expander: Turbo expander power plants use the expansion of natural gas to drive a turbine. The turbine is connected to a generator, which converts the mechanical energy of the turbine into electricity. The amount of electricity that can be generated by a turbo expander power plant depends on the pressure and flow rate of the natural gas entering the facility, so businesses that use large volumes of natural gas sourced from high-pressure gas lines will benefit most from this technology.

- Heat Pumps: A heat pump is a device that can transfer heat from a low-temperature source to a high-temperature source. Heat pumps can be used to heat buildings in the winter and cool them in the summer. Businesses that would benefit from heat pumps include commercial buildings, schools, and hospitals.

Economics have never been better.

While very effective at producing useful electricity, heating or cooling, waste energy recovery technologies are fairly capital intensive on the front end. There are three key factors that can help these projects overcome the initial capital investment:

- Attractive Tax Incentives – The Inflation Reduction Act (IRA) provides federal tax credits of 30%, 40% or even 50% of the project cost. The exact amount of the tax credits a project can qualify for depends on the project’s location, as well as the qualifications of the labor used and the source of the raw materials used in the project’s construction. On the low end, waste energy recovery projects can qualify for as little as six percent of federal tax credit if the labor, materials, and location do not meet the specific requirements of the IRA.

- High-Capacity Factors – Unlike wind and solar projects, which are inherently intermittent in nature, typical waste energy recovery projects produce electricity at a consistent output around the clock when connected to steady-state processes. This high utilization helps justify the initial expense and can provide consistent benefits when being used to reduce a site’s electricity expense.

- Sustainability Goals – Depending on the state where the projects are located, the electricity produced by these waste energy recovery technologies can qualify for renewable energy credits (RECs) to help meet your sustainability goals.

Waste energy recovery project economics have never been better due to strong federal tax incentives, high-capacity factors, and increased recognition of the sustainability benefits by state Renewable Portfolio Standards (RPS).

Interested in learning more?

If you are interested in pursuing a waste energy recovery project, it is important to obtain a full understanding of the specific requirements of the Inflation Reduction Act to maximize tax benefits available to a project. It is critical to understand how those benefits are impacted by project location, by the labor used in construction, and by the source of the materials used in construction, as each of these can have significant impact on the extent of the tax credits available to a project and the overall economics of the project.

We have the expertise and experience to help our customers identify, design, build, own and operate waste energy recovery projects, maximize project tax credits, optimize project performance and ultimately help our customers meet their energy and sustainability goals. To learn more, please contact us here.